The global tax landscape has rapidly transformed in recent times, bringing both challenges and opportunities for businesses all over the world. This shift can largely be attributed to the OECD’s Base Erosion and Profit Shifting (BEPS) 2.0 project, specifically Pillar Two. A key component of Pillar Two, which introduces a global minimum tax of 15%, is the Qualified Domestic Minimum Top-up Tax (QDMTT).

What is QDMTT?

QDMTT is a tax levied by a country to ensure that multinational enterprises (MNEs) operating within a jurisdiction pay a minimum effective tax rate (ETR) of 15%. It acts as a “top-up” tax, applicable when the ETR falls below the global minimum. QDMTT is formulated to work alongside other Pillar Two rules like the Income Inclusion Rule (IIR) and the Under-Taxed Payments Rule (UTPR).

Why is it important?

QDMTT plays a fundamental role in implementing the objectives of Pillar Two. By ensuring that MNEs pay a minimum level of tax on their global income, QDMTT prevents profit shifting and tax avoidance. This approach helps to establish a more transparent international tax system, reducing complexities for businesses operating across borders. Governments are also enabled to maintain control over tax policies while adhering to international standards. This rule also drives MNEs to put more emphasis on economic factors, rather than tax considerations, while making investment decisions. It is because the 15% global minimum tax reduces the advantages of locating activities or profits in low-tax jurisdictions. By narrowing the gap between tax rates across countries, QDMTT limits the ability of MNEs to achieve tax savings through traditional tax-planning strategies. As a result, investment choices must rely more on real business drivers such as market potential, workforce skills, supply-chain efficiency, and operational costs.

How does it affect MNEs?

The introduction of QDMTT significantly reshapes how MNEs approach global tax management. It adds an additional layer of jurisdiction-specific rules that MNEs must incorporate into their existing Pillar Two analyses. Because each country may adopt different legislative approaches for its QDMTT, MNEs are required to track multiple local implementations and understand how each interacts with the broader GloBE framework. They must evaluate the tax position of every entity within each jurisdiction to determine whether a domestic top-up tax applies. This directly affects corporate tax planning, internal controls, financial reporting processes, and the structuring of business operations. MNEs will now require systems that can handle granular jurisdiction-level calculations, import data from multiple sources, apply evolving local rules, and ensure alignment between QDMTT determinations and overall Pillar Two outcomes. This shift moves tax teams away from manual, spreadsheet-based approaches and towards advanced tax technology platforms capable of supporting consistent, audit-ready compliance.

What challenges do MNEs face in complying with Pillar Two?

Navigating the complexities of Pillar Two presents considerable challenges for MNEs. Managing the sheer volume of data required to make accurate calculations is the first and foremost challenge. MNEs must gather and analyze financial information from all their global entities while ensuring consistency and accuracy across different accounting standards and reporting systems.

Moreover, the complexity of the GloBE rules themselves poses a substantial challenge. The intricate calculations required to determine the top-up tax demand a deep understanding of international tax laws. MNEs must navigate the interaction of multiple Pillar Two provisions like the IIR, UTPR, and various safe harbors which can influence the final tax outcome. These rules also need to be applied consistently across jurisdictions that may follow different accounting standards, further complicating calculations and increasing the potential for mismatches or inconsistencies. Manual calculations and spreadsheet-based approaches are simply inadequate for managing these complexities, increasing the risk of errors and non-compliance.

The evolving nature of the GloBE rules and their implementation across different jurisdictions adds another layer of difficulty. MNEs must be able to monitor their global tax position continuously, anticipating the impact of changing regulations and adapting their compliance strategies accordingly. This requires continuous monitoring of regulatory changes, participation in industry forums, and close collaboration with tax advisors.

Finally, the need for seamless integration with existing financial and tax systems is crucial. MNEs must ensure that their compliance solutions can seamlessly connect with their enterprise resource planning (ERP) systems, tax reporting software, and other relevant platforms. This integration is essential for automating data collection, simplifying calculations, and ensuring data accuracy.

These challenges highlight the critical need for advanced tax technology solutions designed to automate, optimize, and simplify Pillar Two compliance. Without the right technology, MNEs risk facing significant compliance burdens, increased tax liabilities, and potential reputational damage.

Orbitax Global Minimum Tax & Filing Manager: End-to-End Pillar Two Compliance

The Orbitax Global Minimum Tax (GMT) solution and Orbitax Filing Manager work together to deliver a seamless, end-to-end Pillar Two compliance experience. GMT provides fully automated, jurisdiction-specific QDMTT, IIR, UTPR, and STTR calculations using local country rules, all powered by daily updates, 90+ data connectors, and comprehensive reporting with Microsoft Power BI. Filing Manager complements this by offering the latest Pillar Two tax forms, complete with certified translations, fillable formats, validation checks, and official export outputs such as XML and PDF. GMT calculation data can be imported directly into these forms, eliminating manual data entry and ensuring consistency between calculations and filings. Together, GMT and Filing Manager provide tax teams with one integrated platform to prepare, review, and submit accurate Pillar Two filings across all jurisdictions with confidence and efficiency.

Introducing the 2025 QDMTT Bundle: A Single Source for Key Forms

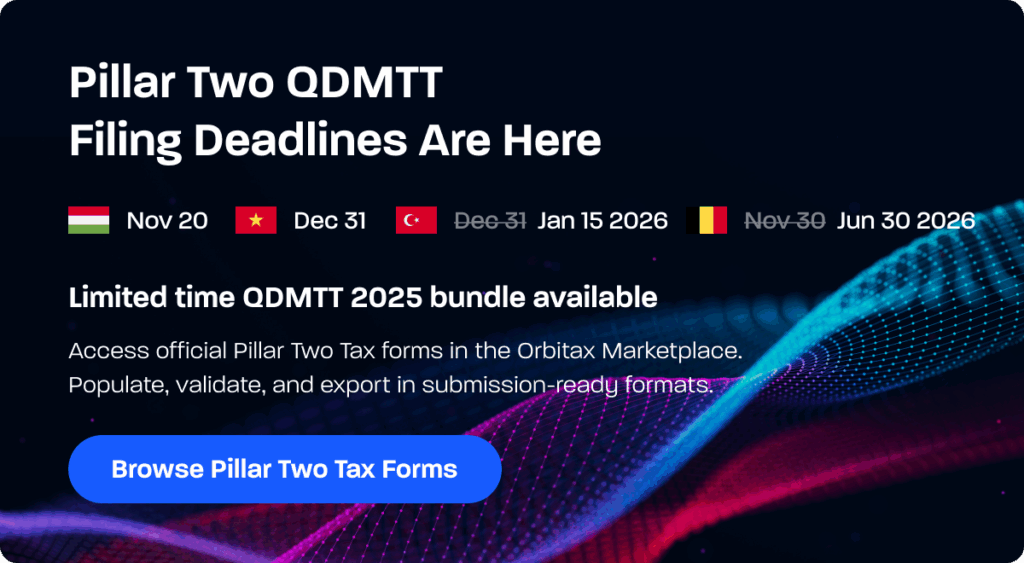

To support organizations preparing for the November – December 2025 filing period, Orbitax has launched a new QDMTT Form Bundle on the Orbitax Marketplace offering four essential Pillar Two forms in one package, even for organizations that do not use Orbitax GMT.

The bundle includes local QDMTT forms for Belgium, Hungary, Vietnam, and Turkey (to be published following the authority’s release). Each form comes with certified English translations, fillable formats, and support for export into official filing outputs such as XML or PDF.

This limited-time bundle is available for USD 5,000, providing an efficient way for tax teams to secure all required 2025 QDMTT forms well ahead of the filing window.