Overview

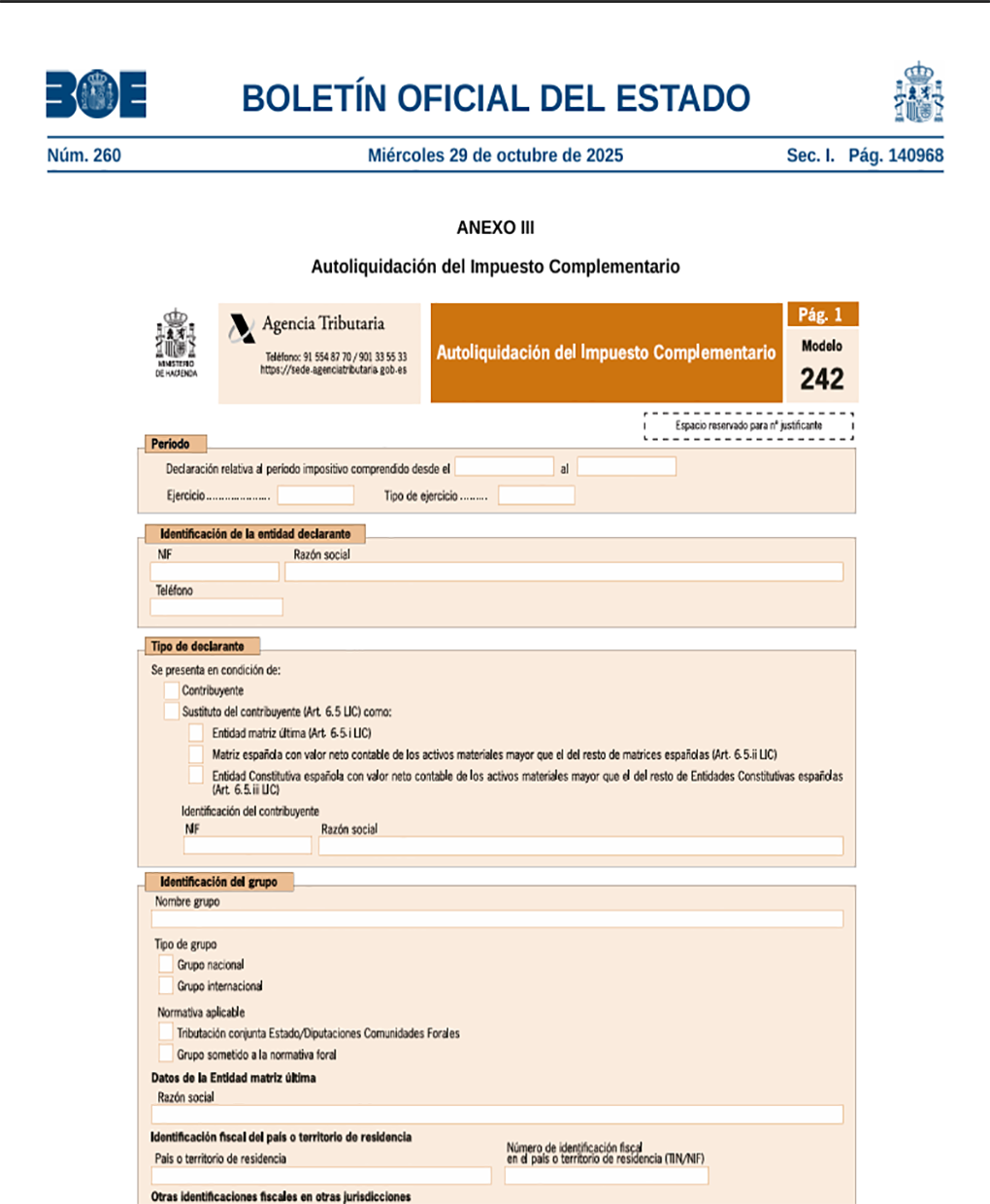

The Spain Pillar Two QDMTT Form is a jurisdiction-specific tax form used to report Spain's Qualified Domestic Minimum Top-Up Tax as part of Pillar Two compliance. It captures all required GloBE income, covered taxes, ETR data, and QDMTT computations in line with Spain's legislative implementation. This template aligns fully with Spain's Pillar Two rules and the OECD Global Minimum Tax (GloBE) framework.

What's Included

Forms Library

The latest jurisdiction-specific Pillar Two forms.

Orbitax endeavors to publish all forms shortly after the local authorities publish or update a form, meaning no more searching across portals or worrying about outdated versions.

Fillable Forms

Ready-to-use, fillable Pillar Two forms that can be automatically populated with data from the Orbitax Global Minimum Tax Pillar Two solution, minimizing manual entry and ensuring consistent, accurate filings on time.

Certified Translations

Seamlessly handle multilingual tax filings with built-in certified tax form translations.

Orbitax ensures you can review and complete forms in your preferred language, reducing the risk of misinterpretation

Validation & Review

Ensure accuracy before submission with automatic validation and review tools.

Orbitax checks each form for completeness, and flags potential errors, helping you submit securely and confidently.

Filing & Transmissions

Submit directly to the relevant government portals or follow instructions when e-filing is not supported.

Orbitax provides official export formats (e.g. XML) and centralizes all submission activities, eliminating fragmented workflows

Collaboration

Collaborate effortlessly across teams and timezones with integrated workflows.

Request missing data, assign review tasks, and track filing progress in real time.

Use Orbitax's Pillar 2 Software to pre-populate your forms with accurate calculation data.

How It Works

1. Upload Group or entity-level data

Upload group- or entity-level data to create a single source of truth inside the platform.

2. Choose the required Pillar 2 Tax Form

Choose the form you want to work with, assign a form title, select the reporting entity, and set the UPE currency- automatically populated from your uploaded entity data.

3. Access form filing instructions

Access form-filling instructions directly within the platform, available in both the local authority's language and English (where provided).

4. Complete the required form input fields

Complete required fields manually or use data-collection workflows to invite stakeholders (e.g., preparers, reviewers, managers) via email. Users with an active GMT license can pull relevant data directly from GMT scenarios which are auto-mapped to relevant fields.

5. Leverage built-in validation tests

Leverage built-in field-level validation checks to ensure accuracy, then generate or export the completed [FORM TYPE] in the required formats (PDF, XML).

6. Transmit directly via Orbitax or manually

Direct transmission of XML and PDF filings to tax authority portals.

Compliance Coverage

Supports OECD Pillar Two / GloBE compliance under Spain’s Self Assessment Return legislation.

Aligned with Spain’s local implementation rules and guidance.

Applicable for fiscal years from 2024 onwards.

Helps prepare Spain Self Assessment Return disclosures for in-scope multinational groups.

Designed to support transitional and safe harbour rules, where applicable.

Form Benefits

- Ensure accurate and compliant QDMTT reporting aligned with Spain’s Pillar Two filing requirements

- Reduce manual data handling and minimize errors in Spain’s QDMTT top-up tax submission

- Support consistent and standardized GloBE reporting across all constituent entities

- Keep filings aligned with both OECD GloBE rules and Spain’s local legislation

- Simplify coordination between global and local teams for Pillar Two compliance

Form Details

| Jurisdiction | Form Type | Filing Level | Filing Method | Effective Date | Due Date |

|---|---|---|---|---|---|

| Spain | Self Assessment Return | N/A | N/A | 12/31/2023 | N/A |